Oil prices fell more than $2 per barrel on Monday after reports that Iran is seeking an end to hostilities with Israel, raising the possibility of a truce and easing fears of a disruption to crude supplies from the region.

Brent crude futures fell $2.65, or 2.7%, to $71.58 a barrel by 11:05 a.m. ET (1506 GMT). U.S. West Texas Intermediate crude futures fell $2.71, or 3.7%, to $70.27 per barrel.

Iran has asked Qatar, Saudi Arabia and Oman to press U.S. President Donald Trump to use his influence on Israel for an immediate ceasefire in return for Tehran's flexibility in talks about its nuclear program, two Iranian and three regional sources told Reuters. Earlier, the Wall Street Journal had reported Iran was seeking a truce.

Traders pared bets that bombing by both sides could turn into a broader, regional war that would threaten energy infrastructure, Mizuho analyst Robert Yawger said.

On Friday, oil prices surged more than 7% after Israel began bombing Iran over claims Tehran was close to securing an atomic bomb.

Both sides have traded airstrikes, including on energy infrastructure, but key oil export facilities have not yet been hit.

"The Israelis have not touched Kharg Island, so that is the story right now," Yawger said, referring to the Iranian oil export hub.

He cautioned that any strikes on Kharg Island would likely send oil prices soaring to $90 a barrel.

"It all boils down to how the conflict escalates around energy flows," said Harry Tchilinguirian, group head of research at Onyx Capital Group.

"So far, production capacity and export capacity have been spared and there hasn't been any effort on the part of Iran to impair flows through the Strait of Hormuz."

Electronic interference with commercial ship navigation systems has surged in recent days around the Strait of Hormuz and the wider Gulf, which is having an impact on vessels sailing through the region, naval forces said on Monday.

About a fifth of the world's total oil consumption, or some 18 to 19 million barrels per day of oil, condensate and fuel, passes through the strait.

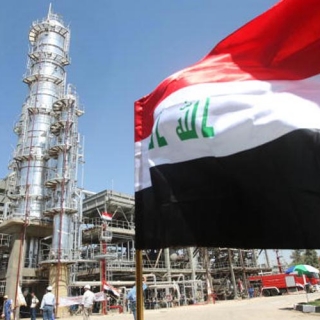

Iran, a member of the Organization of the Petroleum Exporting Countries, currently produces around 3.3 million bpd and exports more than 2 million bpd of oil and fuel.

The spare capacity of OPEC+ oil producers to pump more to offset any disruption is roughly equivalent to Iran's output, according to analysts and OPEC watchers.

"If Iranian crude exports are disrupted, Chinese refiners, the sole buyers of Iranian barrels, would need to seek alternative grades from other Middle Eastern countries and Russian crudes," Richard Joswick, head of near-term oil analysis at S&P Global Commodity Insights, said in a note.

Source: Investing.com

Oil steadied after posting two weekly declines, as traders weighed concerns about a looming global glut and the fallout from US sanctions against Russian producers at the start of a data-heavy we...

Crude prices recovered from a midday dip on Friday on hopes Hungary can use Russian crude oil as U.S. President Donald Trump met Hungary's Prime Minister Viktor Orban at the White House. Brent crude ...

Oil prices rose on Friday (November 7th), but remained on track for a second straight weekly loss after three days of declines on oversupply concerns and slowing US demand. Brent crude rose 60 cents,...

Oil prices edged higher but remained on track for a second weekly decline. West Texas Intermediate (WTI) briefly approached $60 per barrel, while Brent held steady around $63 on Thursday. However, bot...

Oil prices declined on Thursday as investors considered a potential supply glut, as well as weakened demand in the United States, the world's largest oil consumer. Brent crude futures settled down 14...

Japanese stocks are higher thanks to a weaker yen and hopes for domestic earnings growth. Tech and energy stocks are leading gains. NEC is up 2.7% and Inpex is 2.3% higher. Meanwhile, Honda Motor is down 3.8% after it cuts its fiscal-year earnings...

China has begun designing a new rare earth licensing regime that could speed up shipments, but it is unlikely to amount to a complete rollback of restrictions as hoped by Washington, industry insiders said. The Ministry of Commerce told some rare...

Gold edges higher in early Asian trade amid signs of U.S. economic weakness which typically enhance the safe-haven allure of the precious metal. The University of Michigan survey's headline index fell to 50.3 in November, from 53.6 last month,...

European stocks fell on Friday as investors digested more quarterly earnings, but weekly losses were inevitable, with concerns regarding overheated...

European stocks fell on Friday as investors digested more quarterly earnings, but weekly losses were inevitable, with concerns regarding overheated...

Two weeks before the US Federal Reserve's final meeting, with the federal government's data taps closed, Atlanta Fed staff bolstered their economic...

Two weeks before the US Federal Reserve's final meeting, with the federal government's data taps closed, Atlanta Fed staff bolstered their economic...

US stocks rebounded from early losses to close mostly higher on Friday amid hopes that Congress members were making progress toward ending the...

US stocks rebounded from early losses to close mostly higher on Friday amid hopes that Congress members were making progress toward ending the...

European markets opened higher on Friday (November 7th), recovering some of the previous session's losses amid concerns about an AI bubble. The...

European markets opened higher on Friday (November 7th), recovering some of the previous session's losses amid concerns about an AI bubble. The...